The 2-Minute Rule for Estate Planning Attorney

A Biased View of Estate Planning Attorney

Table of ContentsIndicators on Estate Planning Attorney You Need To KnowThe Best Guide To Estate Planning AttorneyIndicators on Estate Planning Attorney You Should KnowGetting The Estate Planning Attorney To WorkThe Estate Planning Attorney DiariesEstate Planning Attorney Things To Know Before You BuyEstate Planning Attorney Fundamentals Explained

A knowledgeable attorney can supply beneficial assistance when taking care of assets throughout one's life time, moving residential property upon death, and decreasing tax obligation responsibilities. By asking such inquiries, a person can acquire insight right into an attorney's credentials and identify if they are a great fit for their particular scenario. With this info, individuals will certainly better recognize just how their estate plan will be taken care of with time and what actions need to be taken if their scenarios change.It is advised that individuals yearly examine their strategy with their attorney to guarantee that all documents are exact and current. During this review process, inquiries about possession monitoring and tax obligations can also be resolved. By collaborating with a seasoned lawyer that understands the needs of their customers and stays existing on changes in the regulation, people can feel great that their estate strategy will certainly show their wishes and objectives for their recipients if something were to occur to them.

A good estate preparation attorney should recognize the regulation and have a strong history in giving sound guidance to help customers make notified choices regarding their estates. When interviewing possible estate lawyers, it is vital to request references from customers they have formerly worked with. This can give important understanding into their capacity to establish and carry out a reliable prepare for each customer's distinct circumstances.

Estate Planning Attorney - Questions

This might consist of drafting wills, depends on, and various other papers connected with estate planning, supplying advice on tax matters, or coordinating with various other experts such as economic planners and accountants - Estate Planning Attorney. It is likewise a great concept to determine if the attorney has experience with state-specific laws or policies associated to possessions to make sure that all necessary steps are taken when creating an estate plan

When creating an estate plan, the length of time can vary significantly depending upon the complexity of the individual's circumstance and requirements. To make sure that an efficient and detailed strategy is established, individuals ought to make the effort to discover the ideal attorney who is knowledgeable and well-informed in estate planning.

The documents and instructions produced during the preparation procedure end up being legitimately binding upon the customer's fatality. A professional financial advisor, based on the wishes of the deceased, will then begin to distribute depend on possessions according to the customer's directions. It is essential to keep in mind that for an estate strategy to be efficient, it needs to be appropriately applied after the customer's fatality.

The Greatest Guide To Estate Planning Attorney

The selected executor or trustee must make certain that all possessions are dealt with according to lawful demands and according to the deceased's dreams. This commonly includes collecting all documents pertaining to accounts, investments, tax obligation records, and various other products specified by the estate strategy. Additionally, the administrator or trustee may require to coordinate with financial institutions and beneficiaries involved in the circulation of assets and various other matters relating to settling the estate.

People need to clearly recognize all facets of their estate plan before it is instated. Collaborating with a seasoned estate preparation attorney can aid make certain the files are properly composed, and all expectations are met. Furthermore, an attorney can give understanding into just how different lawful tools can be utilized to secure assets and make the most of the transfer of wide see range from one generation to one more.

Getting My Estate Planning Attorney To Work

Inquire concerning their experience in handling intricate estates, including depends on, wills, and various other files associated with estate planning. Figure out what type of education and training they have actually received in the field and ask if they have any type of customized knowledge or certifications in this field. Furthermore, inquire regarding any type of costs linked with their services and determine whether these expenses are dealt with or based upon the job's complexity.

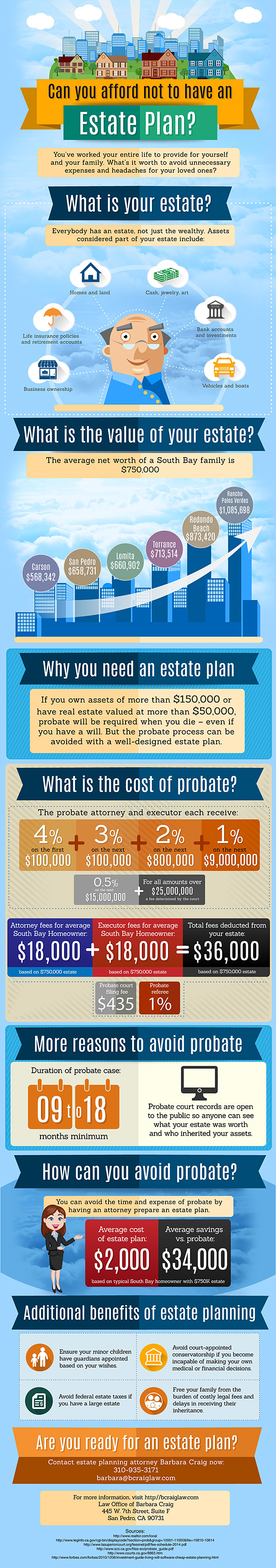

Estate planning refers to the preparation of tasks that manage an individual's financial situation in case of their incapacitation or fatality. This preparation consists of the legacy of possessions to beneficiaries and the settlement of inheritance tax and financial obligations, together with other considerations like the guardianship of minor children and pets.

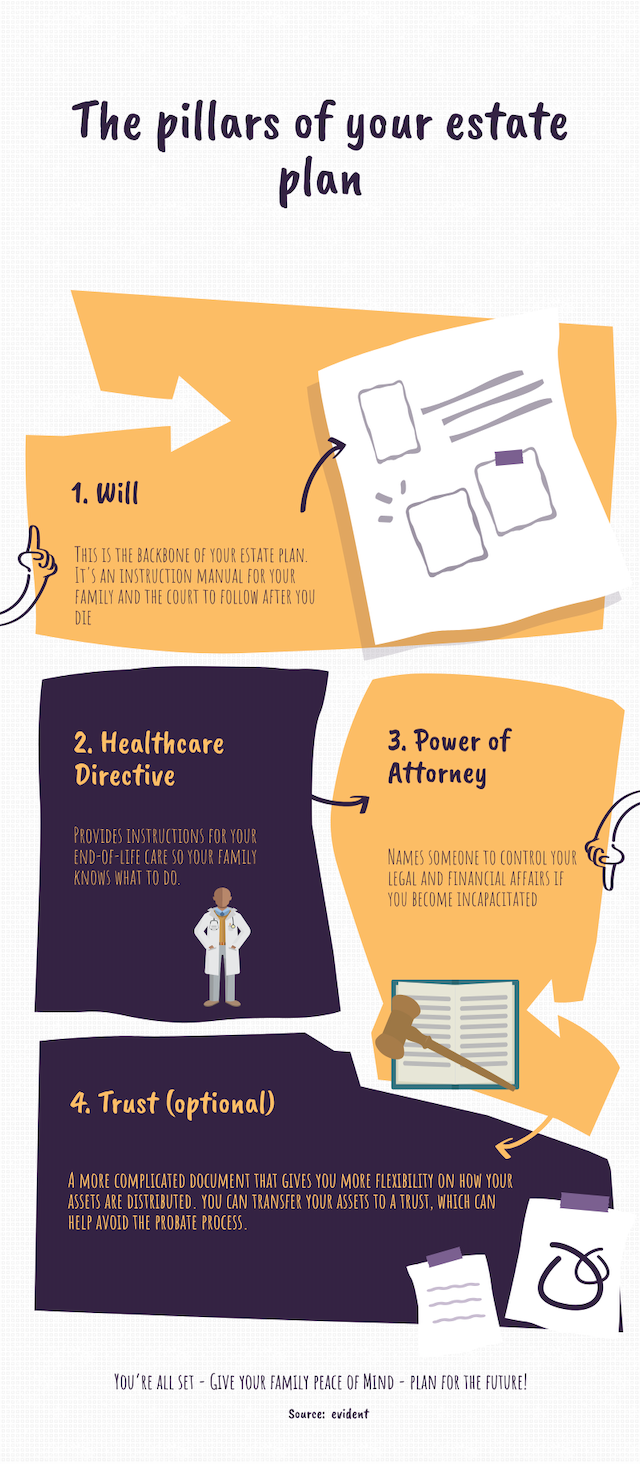

Some of the actions consist of providing possessions and financial obligations, examining accounts, and composing a will. Estate planning jobs consist of making a will, establishing counts on, making charitable contributions to restrict estate taxes, naming an administrator and recipients, and establishing up funeral arrangements. A will offers guidelines regarding residential property and wardship of small kids.

Everything about Estate Planning Attorney

Estate planning can and ought to be utilized by everyonenot simply the ultra-wealthy., took care of, and distributed after death., pensions, financial debt, and extra.

Anybody canand shouldconsider estate planning. There are numerous factors why you could begin estate planning, such as protecting household riches, attending to a you can find out more surviving spouse and children, funding kids's or grandchildren's education and learning, and leaving your heritage for a philanthropic reason. Creating a will is just one of the most important steps.

Evaluation your pension. This is very important, especially for accounts that have beneficiaries affixed to them. Remember, any type of accounts with a recipient pass straight to them. 5. Evaluation your insurance policy and annuities. See to it your recipient information is current and all of your other details is accurate. 6. Establish up joint accounts or transfer of death designations.

Some Known Details About Estate Planning Attorney

A transfer of death designation allows you to name an individual who can take over the account after you pass away without probate. Pick your estate manager.

8. Write your will. Wills don't just unwind any kind of monetary unpredictability, they can additionally lay out plans for your minor youngsters and pets, and you can additionally advise your estate to make philanthropic donations with the funds you leave behind - Estate Planning Attorney. 9. Review your documents. Make certain you look over every little thing every number of years and make changes whenever you please.

Send out a copy of your will to your manager. This makes sure there is no second-guessing that a will exists or that it obtains lost. Send one to the individual who will certainly presume obligation for your events after you pass away and keep an additional copy somewhere secure. 11. See a monetary professional.

Estate Planning Attorney Fundamentals Explained

There are tax-advantaged financial investment vehicles you can benefit from to aid you and others, such as 529 university savings prepares for your grandchildren. A will certainly is a legal paper that gives instructions regarding just how a person's building and custodianship of small children (if any) must be taken care of after death.

The will likewise suggests whether a count on must be produced after death.